The growth of technology in Sub-Saharan Africa (SSA) has been nothing short of impressive in recent years. From the proliferation of mobile phones and internet access to the emergence of tech startups and innovation hubs, SSA has become a hotbed of tech activity. This article aims to provide a comprehensive overview of the tech landscape in SSA, highlighting the key players and trends shaping the region’s digital future.

Tech Adoption in Sub-Saharan Africa

One of the key drivers of tech growth in SSA has been the rapid adoption of mobile phones and internet access. According to the World Bank, mobile phone subscriptions in SSA have increased from just 5% in 2000 to over 80% in 2019. Similarly, internet penetration in SSA has grown from less than 1% in 2005 to over 30% in 2020.

This rapid expansion of mobile and internet access has had a transformative effect on the region, enabling the development of new businesses and services that were previously unimaginable. For example, mobile payment platforms such as M-Pesa and Mobile Money have become ubiquitous in many SSA countries, providing millions of people with access to financial services that were previously out of reach.

Tech Startups in Sub-Saharan Africa

The growth of tech in SSA has also been fueled by the emergence of a vibrant startup ecosystem. In recent years, SSA has seen the emergence of a number of successful tech startups, ranging from e-commerce platforms to healthcare startups.

One notable example is Jumia, an e-commerce platform that operates in 14 countries across SSA. Founded in 2012, Jumia has become a major player in the region, offering a range of products and services to consumers. Other successful tech startups in SSA include Andela, a talent development firm that trains software developers in Africa, and M-KOPA, a renewable energy company that provides solar-powered home systems to customers in East Africa.

Innovation Hubs in Sub-Saharan Africa

The growth of tech startups in SSA has been supported by the emergence of innovation hubs across the region. These hubs provide a range of support services to tech entrepreneurs, including funding, mentorship, and networking opportunities.

One of the most successful innovation hubs in SSA is the iHub in Nairobi, Kenya. Established in 2010, iHub has become a hub for tech innovation in East Africa, providing a range of support services to tech entrepreneurs in the region. Other notable innovation hubs in SSA include the Co-Creation Hub in Lagos, Nigeria, and the Meltwater Entrepreneurial School of Technology (MEST) in Accra, Ghana.

Fintechs in SSA: Redefining Financial Services

The growth of mobile technology in Sub-Saharan Africa (SSA) has paved the way for a boom in fintech companies. With low rates of traditional banking and high rates of mobile phone penetration, SSA has become a prime market for the development of financial technology solutions.

One of the most successful examples of fintech in SSA is the proliferation of mobile money services. Platforms like M-Pesa in Kenya and Mobile Money in Uganda have revolutionized the way people access and transfer money, making it easier for people to start and grow businesses and participate in the formal economy. These services have also made it easier for people to save and manage their money, reducing the need for expensive physical banks and ATMs.

In addition to mobile money, fintech in SSA is also finding innovative ways to provide other financial services, such as loans, insurance, and investment opportunities. Companies like Lendable and Cellulant are using technology to connect borrowers and lenders, while Bima and M-KOPA are using mobile platforms to provide insurance and renewable energy solutions to underserved communities.

The growth of fintech in SSA is not only improving access to financial services for individuals, but it is also driving economic development and growth in the region. As more and more people are able to access financial services, they are better able to start and grow businesses, which in turn creates jobs and drives economic growth.

Overall, the growth of fintech in SSA is a promising sign for the future of financial inclusion in the region, and it is likely that we will see even more innovative solutions emerging in the coming years.

Countries with High Concentrations of Tech Companies:

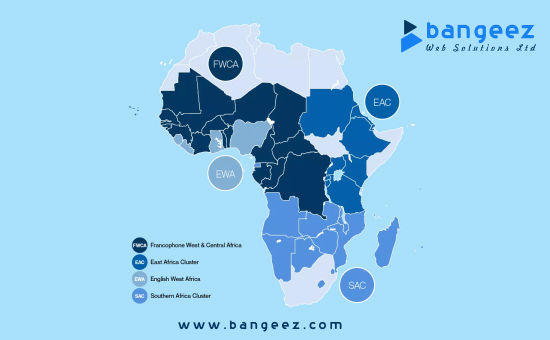

While tech growth in SSA is occurring across the region, a few countries stand out as having particularly high concentrations of tech companies. These include:

- Kenya: Kenya has emerged as a major hub for tech innovation in SSA, with a number of successful tech startups and innovation hubs operating in the country. Notable tech companies in Kenya include M-Pesa, M-KOPA, and Andela.

- Nigeria: Nigeria has a large and growing tech sector, with a number of successful tech startups and innovation hubs operating in the country. Notable tech companies in Nigeria include Jumia, Paystack, Remita, and Flutterwave.

- South Africa: South Africa has a well-established tech sector, with a number of successful tech startups and innovation hubs operating in the country. Notable tech companies in South Africa include Yoco, Jumia, and Takealot.

Conclusion:

In conclusion, the growth of tech in SSA has been nothing short of impressive in recent years. From the proliferation of mobile phones and internet access to the emergence of tech startups and innovation hubs, SSA has become a hotbed of tech activity. While a few countries stand out as having exceptionally high concentrations of tech companies, such as Kenya, Nigeria, and South Africa, tech growth is occurring across the region.

The growth of tech in SSA has had a transformative effect on the region, enabling the development of new businesses and services that were previously unimaginable. It is clear that tech will play a central role in the development of SSA in the coming years, and we can expect to see even more innovative tech companies and startups emerging from the region in the future.